My Blog List

Friday, May 30, 2008

Some ideas on Solving Subsidized Petrol Problems in Malaysia

(1) Cut the Bleeding Arm

The quick fix for all the petrol smugglings, inappropriate consumptions, & you-name-it ..etc. : START SELLING AT NON-SUBSIDIZED PRICES. PERIOD. Don't curse me yet. We need stern policy to get things right top-down. Do it the decisive way. Clean cut, bukan soap opera. (OK, enough). WIth this, lots of administrative works of government will be reduced too, not only the subsidies to those non-entitling parties (sorry to my Singaporean friends loh).

Brilliant right? Now Malaysians will finally realise petrols are precioius. Wastage will be reduced naturally. Probably Malaysians will be more healthy, walk more drive less mah.

(2) Rewards and Penalties

When (1) is implemented, lower income people with own transports will be affected, immediately. To solve this problem of short-term shock, a immediate subsidy should be provided to those entitling vehicle owners directly, eg. Check , direct bank-in, and etc. Comon, you know where to send the Speeding Ticket, then you should know where to send us the moneyyy. JPJ have our records, IRD have our records, blah blah blah. Of course, a careful formula need to be worked out on deciding what type of vehicles entitling to what amount of subsidies. And I do suggest 2.0L and above, get Zero subsidy. 3.0L and above, get to pay additional for Luxury Tax. (or even make it illegal to own 3L car, I don't care). Now you like me better? And I assume you don't drive a Hammer, do you? kekeke. For mid to long term, integrate this whole thing into the income tax form, like adding a row for Petrol Consumption Rebate. Likewise, for the manufacturing / transport industries, tax rebate as subsidy.

(3) Let them Dog Eat Dog for Malaysians' sakes

This is the best part, I love this. Now petrol stations sales will be affected, how to attract customers? Cut your prices lah. Cut your margin, hire less workers. Easy licenses don't mean easy money OK. Walk an extra mile, won't you? (err.. I should start marketing electric fly swatter to those petrol stations taukeh..) akekekek.

My simple closing statement: We Malaysians need to be more efficient. PERIOD. (opps, period means more bleeding :D) FULL STOP.

Saturday, May 24, 2008

Gold Mining Company in Malaysia

Old News: PGL in new gold extraction venture

Peninsular Gold Ltd (PGL), the latest to join the gold mining industry in Pahang, is investing in a state-of-the-art Carbonin-Leach processing plant in Raub, which is expected to start production next year.

The plant, with an initial production of 25,000 ounces of gold from Bukit Koman, is geared to step up production eventually to 100,000 ounces a year.

Speaking at the official ground breaking ceremony of the new plant by Datuk Adnan Yaakob, the Menteri Besar (Chief Minister) of Pahang, PGL's Chairman and Chief Executive, Datuk Seri Andrew Kam Tai Yeow said, the new plant, with the latest technology would be able to maximise the extraction of gold from soil by up to 85% from the 15 % based on the conventional technology.

PGL, whose wholly-owned subsidiary, Raub Australian Gold Mining Sdn Bhd, has been granted a 20-year rights to mine gold at the 202-hectare site in Bukit Koman, expects to export the entire production of the gold.

The company, which targets to extract a minimum of five million ounces of gold in Malaysia, is expected to invest an additional RM150 million subsequently, for extensive drilling works and possible expansion of the new plant.

"Malaysia has a mining culture and the operating cost at about US$200 (RM702) an ounce for tailings deposits here is very conducive for gold mining. Kam said.

Tailings deposits are residues from conventional methods of gold extraction, which were not able to get the maximum gold yield from the soil. Hence the new plant will be able to process up to 1.1 million tonnes of tailings a year.

PGL, listed on the Alternative Investment Market of the London Stock Exchange, has brought in more than RM50 million from its London listing in 2005, to invest in its gold mining and exploration operations in Malaysia. To-date, it has invested RM25 million for exploration works in Bukit Koman.

With the current gold prices of between US$680 and US$700 (RM2,380 and RM2,457) an ounce, the company expects to generate some RM60 million a year in revenue just from its initial production.

Adapted from NST Business Times, 3 March 2007

Thursday, May 22, 2008

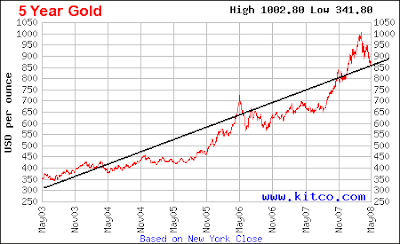

Gold is Hot, but Expect Some Strong Resistance Ahead

Tuesday, May 20, 2008

Buffett Chicken Soup of the Day

...But if a business requires a superstar to produce great results, the business itself cannot be deemed great. A medical partnership led by your area’s premier brain surgeon may enjoy outsized and growing earnings, but that tells little about its future...

Ring any bell? Yeah, Tony & Airasia.. wa ha ha..

Monday, May 19, 2008

Move On and Move Forward

...Third, the fall in global supply also contributed to the rise in the price of gold. In 2007, global supply of gold dropped 3.0% year-on-year to 3,469 tonnes.

Mine production sagged 2.9% year-on-year to a 10-year low of 2,047 tonnes (2,108 tonnes in 2006). Over 2004 to 2007, the top suppliers have cut their production levels as a result of rising exploration and mining costs. For example, South Africa, the US, and Australia cut their production by 36.3%, 15.5%, and 28.9%, respectively to 272 tonnes, 250 tonnes, and 251 tonnes by 2007.

Only China has consistently raised its production levels from 172 tonnes in 2004 to 270 tonnes in 2007...

Saturday, May 17, 2008

Friday, May 16, 2008

Golden Dragon Can't Hide No More

Wednesday, May 14, 2008

Exchange Rate RM 3.2665 / USD !

Need some charge-up this morning?

Leadership is about supporting and building employee morale and productivity...To maintain and build high performance work relationships you must focus on three core ideas: reduce ambiguity, be fair and stay positive.

Reduce Ambiguity

People hate the unknown, the unclear and the unnecessarily complex... assumptions are rarely correct. Typically, they are negative and self-serving. All of this is time not spent working productively because you failed to go the extra few steps required to really reduce ambiguity.

...With great communication and clear performance goals you will go a long way towards reducing unnecessary employee ambiguity.

Be Fair

This does not mean treating people the same. You only want to treat people identically in terms of creating an environment where expectations are clear and opportunities are open to everyone...

One vital key to not only being fair, but being perceived as fair, is to allow people a voice in shaping decisions that affect them...

Stay Positive

Positive emotions (just like negative emotions) are infectious...

Next, realize that to be a leader is to be a cheerleader....

Author's Bio : Dr. Dewett

Dr. Dewett is a business professor, author, consultant and speaker specializing in leadership and organizational life... more at drdewett.com.

Tuesday, May 13, 2008

Crude Palm Oil Weely Chart 080513

CPO weekly chart doesn't look very healthy, has been very volatile for the past few weeks. But.. but.. this plantation counter is whispering to me to take her leh.. how ar?

Sunday, May 11, 2008

KLCI Weekly Chart Review 080509

KLCI weekly chart flirted around with its trend line. 1297 level proves to be tough resistance. Most likely it will come down again before another attempt to break the 1297.

Crude Palm Oil: This one is worth watching as it might have found some support and ready to trend up again.

Saturday, May 10, 2008

Results are out! Case Study: A Tale of Three Steel Kingdoms

He he, the news was out on 9/May, about Malaysia scrapping ceiling price on steel bars. Now, it is time to take a look at these 3 steel kingdoms' performances since I last blogged about it...

1) Annjoo +16%

2) Kinstel +10.71%

3) Onastel +7.7%

My pick on Annjoo about 3 months ago was genius like. The credits should go to Chart Reading. Nonetheless, I think the steel play is over, since the news has already removed market anticipation.

Thursday, May 8, 2008

Gold is in Correction Mood II

Seems like not coming down any further for now. RM getting weak against USD. Is this the good timing now? I think the margin of safety is good.

Buffett the Investor or Great Trader?

Excerpted from his 2007 letter to Berkshire Hathaway Inc. shareholders (which didn't come with the picture...):

Excerpted from his 2007 letter to Berkshire Hathaway Inc. shareholders (which didn't come with the picture...):...We made one large sale last year. In 2002 and 2003 Berkshire bought 1.3% of PetroChina for $488 million, a price that valued the entire business at about $37 billion. Charlie and I then felt that the company was worth about $100 billion. By 2007, two factors had materially increased its value: the price of oil had climbed significantly, and PetroChina’s management had done a great job in building oil and gas reserves. In the second half of last year, the market value of the company rose to $275 billion, about what we thought it was worth compared to other giant oil companies. So we sold our holdings for $4 billion.

They purchased PetroChina when we were ignorant of global crude oil supply issues "years before". They disposed PetroChina when we were just "starting" to notice bullish China market. They made 700% ROC (grossly, not factored in dividends, exchange rate gain, taxes, and etc.) in just about 5 years time. If that is not called smart money, what else is? Do you still think Buffett is a slow moving boring old fat investor? Think again. He is a probably greatest and fastest moving trader on earth.

Wednesday, May 7, 2008

Buffett on Lousy Business

... The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and then earns little or no money. Think airlines. Here a durable competitive advantage has proven elusive ever since the days of the Wright Brothers. Indeed, if a farsighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favor by shooting Orville down.

Shooting down Orville (of the Wright Brothers)? kekeke..talk about werid sense of humor.

Apply it to our KLSE : Still interested in Airasia? Helloooo.. anyone?

Tuesday, May 6, 2008

Investment Can be very Easy

Sunday, May 4, 2008

The King has Spoken

May 3 (Bloomberg) -- Warren Buffett, chief executive officer of Berkshire Hathaway Inc., said the global credit crunch has eased for bankers, and the Federal Reserve probably averted more failures by helping to rescue Bear Stearns Cos.

``The worst of the crisis in Wall Street is over,'' Buffett said today on Bloomberg Television. ``In terms of people with individual mortgages, there's a lot of pain left to come.'' Buffett was interviewed before the Omaha, Nebraska-based company's annual meeting, attended by about 31,000 people.

Saturday, May 3, 2008

KLCI: The Big Picture

Do you buy this theory? Whether or not, hard to ignore. Smart Money leads, Dumb Money follows. Something never changes.

Do you buy this theory? Whether or not, hard to ignore. Smart Money leads, Dumb Money follows. Something never changes.

KLCI Review 080502

Eden: Still looks ok for me to re-enter. My guess is it is under major accumulation. Distribution is unlikely, looking at the above average volume with green closing of late. Remember, KLCI sentiment prevails.

Friday, May 2, 2008

Gold is in Correction Mood (Second Opinion)

Interesting second opinion from the professional of a local bank.

http://klse2118.blogspot.com/2008/05/133-pm-gold-and-commodities-investing.html

Naza founder passes away

(Update: OK, it is on all main stream medias already)

Thursday, May 1, 2008

Head and Shoulders... Hope not.

Gold is in Correction Mood

Will see if it can get strong support at 800 level. If it move back up again after hitting 800 level, I will join the gold rush. wa ha ha ha.

Will see if it can get strong support at 800 level. If it move back up again after hitting 800 level, I will join the gold rush. wa ha ha ha.